Tailored Solutions That Grow With You

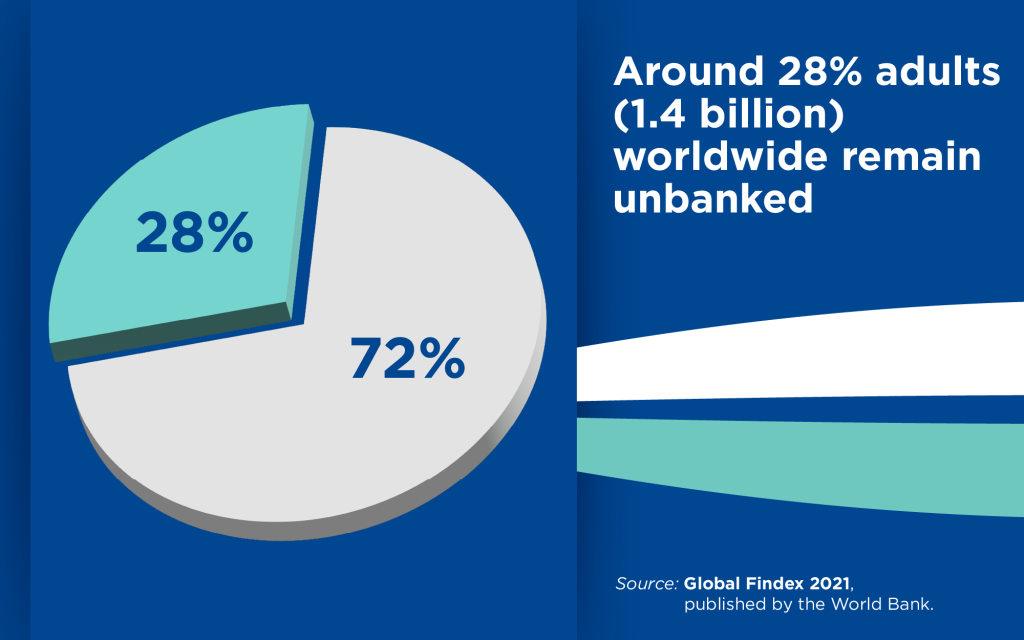

Around 1.4 billion adults worldwide remain unbanked, meaning they do not have an account with a financial institution or a mobile money provider according to Global Findex 2021, published by the World Bank. This marks significant progress compared to 2.5 billion in 2011 and 1.7 billion in 2017.

Unbanked populations are overwhelmingly concentrated in developing economies, as account ownership is nearly universal in high income countries. In fact, 54% of all unbanked adults, approximately 740 million people, are located in just seven countries.

Microfinance institutions (MFIs) play a vital role in addressing this global challenge. They are offering accessible financial services, bridging the digital gap, expanding outreach in rural areas, supporting women and marginalized groups, promoting financial literacy, being flexible and having inclusive credit assessments, and actively encouraging first time account ownership.

Despite playing an essential role in the financial sector, Microfinance institutions (MFIs) face several challenges, that prevent them from reaching their full potential.

Hurdles to Impact: Why Microfinance isn’t Reaching it’s Full Potential and How Modular Banking Can Help

Microfinance institutions are uniquely positioned to reduce the global unbanked population by designing services that are local, inclusive, and adaptable. But without the right digital infrastructure, like the flexibility offered by modular banking, they often struggle to scale, cut costs, or respond to evolving client needs.

With continued investment in digital infrastructure, education, and policy support, MFIs can dramatically accelerate financial inclusion across developing economies, but the reality is slightly different.

Based on the Microfinance in the Caucasus and Central Asia – 2024 Edition report, here are key reasons why microfinance isn’t reaching its full potential in the region:

- High Operational Costs

Running a microfinance institution isn’t cheap. While some countries have seen efficiency gains, the average operating expense ratio still stands at 14% rising to 22% in Uzbekistan. These costs often get passed on to clients, making loans less affordable and reducing the sector’s ability to scale sustainably.

- Shift Toward Larger Loans

MFIs are now serving a broader spectrum of clients, but not always in line with their core mission. In some cases, loans were over 700% of GNI per capita, primarily aimed at SMEs. Meanwhile, institutions with smaller, truly inclusive loans issued amounts closer to just 7% of GNI per capita. This shift toward higher value lending may support business growth but it risks sidelining the poorest clients.

- Limited Outreach to Youth and Rural Clients

Despite the mission of inclusion:

- Only 53% of MFIs reach rural clients

- Just 29% actively serve youth under 30

These groups represent both the most vulnerable and the most promising future entrepreneurs, leaving them behind means missing out on systemic impact.

- Green Finance Still on the Sidelines

Only 28% of microfinance institutions (MFIs) offer green loans. And even then, most are limited to basic energy-efficiency improvements for homes or small businesses. What’s missing? Dedicated funding, product innovation capacity, and client education on sustainability. Without these, MFIs are missing a key chance to lead in climate resilience for vulnerable populations.

One clear path forward for overcoming these hurdles is adopting modular banking systems that adapt to institutional needs, reduce complexity, and support long-term growth.

Empowering Microfinance Institutions Through Modular Banking: How the Aspekt Product Suite Delivers Results

For many microfinance institutions (MFIs), real progress is often hindered by operational inefficiencies, high costs, and limited technology infrastructure. The result is missed opportunities to serve the underserved. Microfinance institutions (MFIs) are expected to offer more than access to loans. They’re under pressure to be faster, more secure, digitally enabled, and client focused, all while keeping operational costs low.

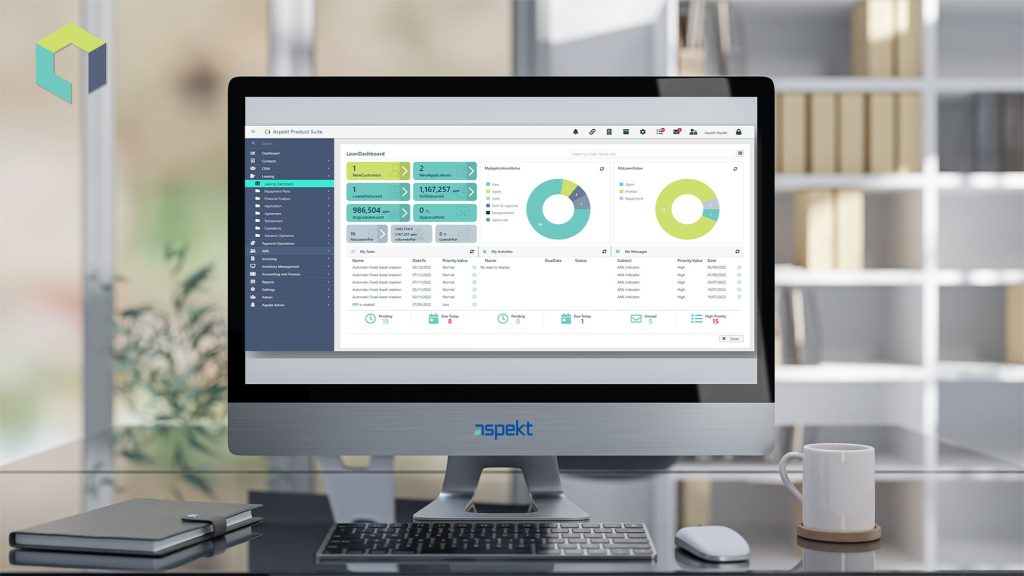

At Aspekt, we believe digital transformation shouldn’t be out of reach for mission-driven institutions. That’s why we built the Aspekt Product Suite; a modular, flexible, and scalable platform tailored for financial institutions like yours. Each module is designed to solve a specific challenge, together, they form a powerful digital backbone for modern financial institutions.

Our solution empowers MFIs to streamline operations, cut costs, automate critical processes, and expand their reach, without compromising their mission. Here’s how our core modules align with the sector’s biggest needs:

Application Processing & Loan Management Modules

The whole process of loan approvals can be time consuming, and human errors are made during the application process. Aspekt Product Suite automates the entire loan lifecycle, reducing the whole processing time and manual errors, while the portfolio quality is improved and the operational costs are reduced.

On Field Assistant

Enable your loan officers to collect and manage data directly from the field, even offline, with the tablet-based platform. This allows loan officers to gather real-time data in remote areas with limited connectivity, reaching more clients. As part of a modular banking strategy, it enables MFIs to deploy tools only where and when they’re needed.

Additionally, the Aspekt Product Suite extends your core services through mobile applications for your existing and potential clients, which are secure, user-friendly, and fully integrated.

Fund Management Module

Gain valuable insight into fund availability and closely monitor usage. Our module centralizes borrower and funder tracking, creating a more efficient environment by aligning disbursed loans with funder payment plans. Get a clear preview of payment maturities. Engage your financials effectively, making informed decisions through automated, streamlined fund allocation and flexible repayment plans.

CRM & Client Profile Modules

Aspekt helps Banks and MFIs build lasting relationships by centralizing customer information, tracking behavior, and enabling product personalization. It provides a 360° client view for better decision-making, and more personalized financial services and Improves customer retention and satisfaction.

AML Module

With built-in AML and fraud-prevention tools, Aspekt ensures Banks and MFIs can meet both local and international regulatory requirements. With these modules, Banks and MFIs will reduce compliance risks, and there will be automation of alerts and transaction checks, providing peace of mind for the investors and outside institutions.

Reporting & Analytics

With built-in analytics and customizable dashboards, MFIs can easily monitor performance and portfolio risk. This directly will impact the efficiency and regulatory reports, dynamic report generation, supporting strategic decisions, and investor relations.

Open APIs & Third-Party Integration

Aspekt’s open architecture allows seamless integration with third parties such as credit bureaus, payment providers, and more.

Designed for Growth, Built for Impact!

The Aspekt Product Suite is not just a software platform, it’s a long-term partner in digital transformation. Whether you serve 5,000 or 500,000 clients, our modular design means you only implement what you need when you need it.

Investing in modern software like a modular banking platform enables digital transformation and automation, improves data accuracy, enhances risk management, and speeds up client service. With a digital platform, institutions can reach more clients, especially in rural and underserved areas, while strengthening operational efficiency, cutting costs, and enabling long-term sustainability.

Ready to evolve your microfinance operations? Let’s talk about how Aspekt can support your mission with powerful, adaptable technology. Book a demo and contact us at sales@aspekt.mk to discover how we can help transform your financial institution with one unified solution, designed to take your operations to the next level.