In recent years, the term “digital transformation” has become a popular catchphrase in financial services. But for microfinance institutions (MFIs), it’s not about trendy terminology—it’s about survival, relevance, and scale. For many, this transformation begins with adopting the right micro lending software to modernize and streamline operations.

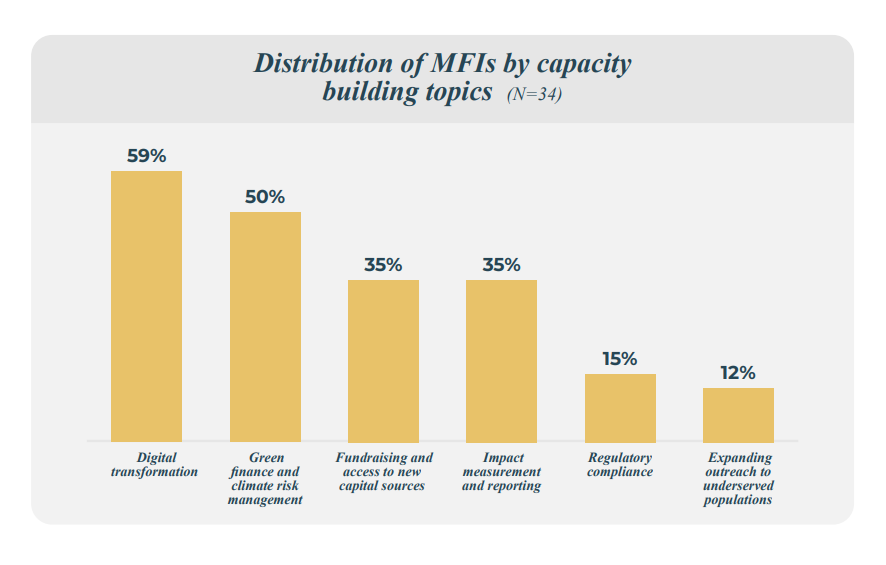

According to the 2024 European Microfinance Survey, 59% of MFIs cite digital transformation as one of their most urgent capacity-building needs. This isn’t just a technical upgrade. It’s a call to rethink how operations, services, and client relationships are built and delivered in a dynamic financial landscape.

Why Micro Lending Software is Key to MFI Growth?

The microfinance sector is undergoing a rapid evolution. In 2023, the total loan portfolio across European MFIs reached EUR 7 billion, serving nearly 1.5 million active borrowers, many of whom are traditionally underserved by mainstream banking.

Just a year earlier, in 2022, the loan portfolio stood at EUR 5.3 billion, with 1.3 million active borrowers. In 2023, the sector grew by over 30% in total portfolio size and added 200,000 more borrowers. This growth shows how microfinance is expanding its reach and impact, helping even more people who are underserved by traditional banks.

But as MFIs grow, things get more complex. Many are expanding their services to include business loans, personal loans, financial education, and green finance. With this growth, they are starting to face real challenges:

- Manual processes that can’t scale

- Disconnected systems for client data and reporting

- Delays in decision-making

- Limited visibility into impact and performance metrics

71% of MFIs employ fewer than 50 staff, yet they are tasked with delivering diverse services across wide geographies, often with limited budgets. The pressure to “do more with less” is pushing many toward digital tools—but not just any tools. They need purpose-built, flexible systems that reflect the realities of their work on the ground.

Across Europe, many microfinance institutions are reaching a turning point. As demand grows and operations become more complex, they’re realizing that paper-based processes and outdated tools can no longer keep up.

According to the 2024 European Microfinance Survey, 59% of MFIs say their top priority is digital transformation—whether that means offering digital financial services, adopting fintech solutions, or building better digital strategies. For these institutions, it’s not just about technology. It’s about finding smarter ways to serve their clients, improve efficiency, and stay ahead in a fast-changing world.

How Micro Lending Software Supports Digital Transformation in Microfinance

As microfinance institutions grow, the limitations of spreadsheets and manual processes become painfully clear. Institutions are looking for more than basic digital tools—they need intelligent systems that adapt to their mission and scale with demand.

The right Micro Lending software delivers real, measurable benefits:

Enhanced Efficiency

Automating routine tasks and streamlining workflows reduces manual effort and eliminates operational bottlenecks—freeing staff to focus on value-added services.

Improved Customer Experience

With faster loan processing, personalized offers, and intuitive digital channels, MFIs can improve service quality and deepen client relationships.

Regulatory Compliance

Built-in compliance checks, audit trails, and reporting tools ensure alignment with evolving regulations—minimizing risks and manual errors.

Data-Driven Decision Making

Advanced analytics and real-time dashboards provide actionable insights that support more informed lending decisions and strategic planning.

Scalability

A modular, flexible architecture makes it easy to launch new products, expand to new regions, or integrate with third-party systems—without overhauling your tech stack.

At Aspekt, we help MFIs move from digital ambition to real transformation—with a platform built to support financial inclusion, transparency, and growth.

Data, Impact, and Accountability

The report also reveals that 83% of MFIs are tracking impact indicators, such as job creation, household stability, and income growth. However, many still struggle with data quality and collection—a challenge that digital tools can directly address.

By centralizing operations and automating data collection at each client touchpoint, MFIs can generate accurate insights that are critical for funding partners, regulators, and internal decision-making. Despite good intentions, 59% of MFIs struggle to engage clients in data collection, and 47% report quality issues. Limited budgets, expertise, and resources make proper impact measurement a challenge—underscoring the urgent need for better tech tools.

Micro Lending Software for Real-World Results

Digital transformation isn’t about adopting the most complex platform—it’s about choosing technology that fits your structure, your clients, and your mission. At Aspekt, we design tools that empower financial institutions to grow sustainably, serve clients more effectively, and maintain full operational control.

For MFIs ready to make digital progress, it’s time to move beyond the buzzwords—and toward real, results-driven transformation.

Where Impact Meets Innovation

Digital transformation in microfinance isn’t about adopting technology for its own sake—it’s about enabling institutions to serve better, grow smarter, and create deeper impact. With rising demand, evolving client needs, and increasing pressure for transparency, MFIs need more than digital ambition. They need the right foundation.

By choosing a micro lending software designed for flexibility, efficiency, and growth, microfinance institutions can future-proof their operations and stay focused on what matters most: empowering people and communities through access to finance.

At Aspekt, we’re committed to helping financial institutions lead this transformation—not just with tools, but with a vision for lasting change. Let’s build it together.

👉 Looking for the right micro lending software? Talk to Aspekt’s experts and start your MFI’s digital journey today.