Managing loans can be complicated, but with the right Loan Management Software, it becomes simple. Designed for banks, microfinance institutions, and leasing companies. Aspekt Product Suite helps speed up loan approvals, streamline processes, reduce risk and improve customer satisfaction.

We spoke to Petre Bozikov, working in Business Development for the SEE Region at Aspekt, to learn how Aspekt Product Suite makes Loan Management easier for financial institutions.

Fast Loan Approvals With Loan Management Software

The Application Processing Module helps institutions approve loans faster. It automates key steps like analyzing customer creditworthiness, checking documents, and ensuring everything complies with the institution’s policies. By utilizing our Application Processing Module, clients can significantly reduce administrative tasks and paperwork, leading to lower operational costs for each loan issued.

Our solution ensures fast and reliable loan approvals,” says Petre Bozikov. “It saves time and makes the process simple for both employees and customers. By utilizing our Task and Messaging Engine, loan officers can easily navigate the predefined steps and conditions for any particular loan product.

End-to-End Loan Management

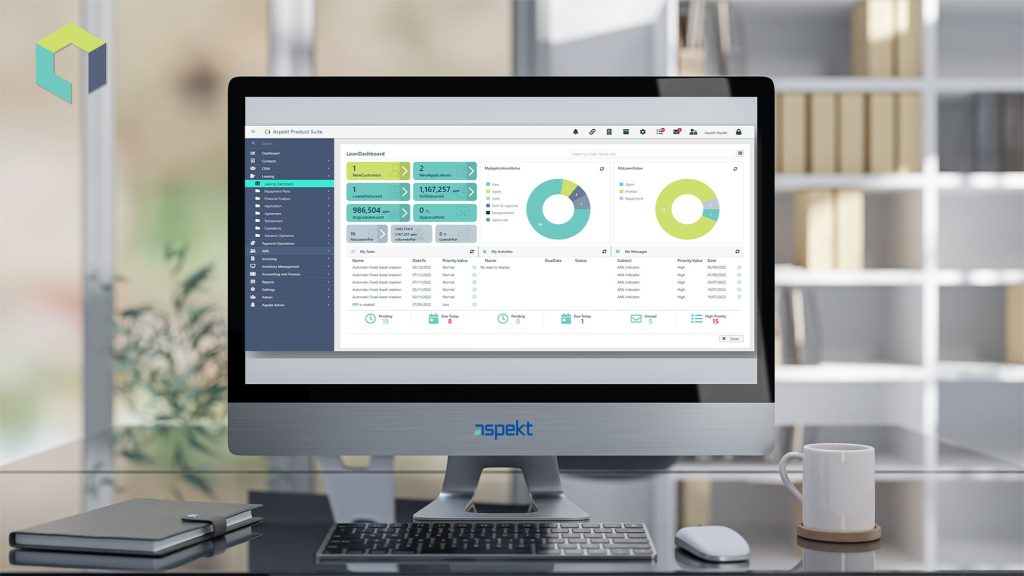

Once a loan is approved, the Loan Module takes over, managing every detail of the loan—from disbursement to repayment. It gives institutions a complete view of the loan and the client, ensuring all information is clear, up-to-date, and easy to access.

The Loan Management Module handles everything, from creating repayment plans to tracking payments, it simplifies the entire process and reduces human errors.

Flexible and Transparent

Aspekt’s Core Banking system is built to adapt to the client needs. It offers tools to adjust repayment plans, restructure loans, and monitor loan performance. The system also provides a clear overview of all loan activities, so institutions always stay in control.

Why Choose Aspekt Product Suite as Your Loan Management Software?

Aspekt Product Suite isn’t just about managing loans, it’s about doing it better. By automating key steps, reducing risks, and offering flexibility, our Core Banking system helps financial institutions improve their operations and serve their customers more effectively.

With our solution, financial institutions can focus on what truly matters — building stronger relationships with their clients while we handle the complexity of loan management.

Petre Bozhikov