Building the Digital Future with Seamless Core Banking Implementation

The Challenge: Modernizing for Growth

Oxus is a dynamic microfinance network operating in Kyrgyzstan, Afghanistan, and Tajikistan, empowering underserved communities with microcredit and essential financial services. Over the years, Oxus Kyrgyzstan has established itself as a stable force in Kyrgyzstan’s microfinance sector, consistently achieving strong financial performance and demonstrating resilience in meeting client needs.

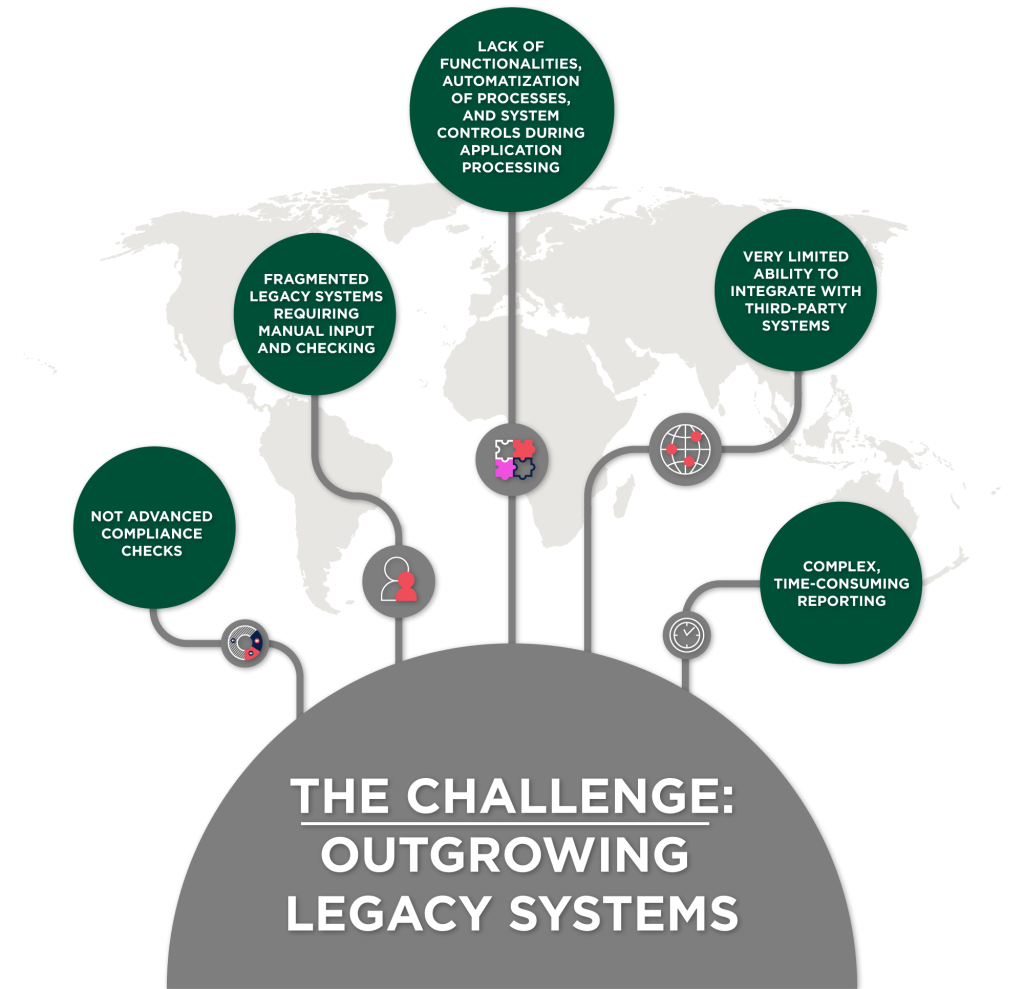

As the institution expanded, the need for a flexible, scalable system became evident. The existing infrastructure created challenges in maintaining operational efficiency and seamless integration, leading the institution to move beyond legacy limitations and implement a platform aligned with its long-term strategic growth objectives.

Recognizing the need for a future-ready platform, Oxus Kyrgyzstan sought to move beyond legacy constraints and implement a comprehensive solution that would unify its operations and support long-term strategic objectives. With Aspekt’s proven expertise and strong local presence in Kyrgyzstan, the partnership was a natural choice.

The Solution: A Unified, Future-Ready System

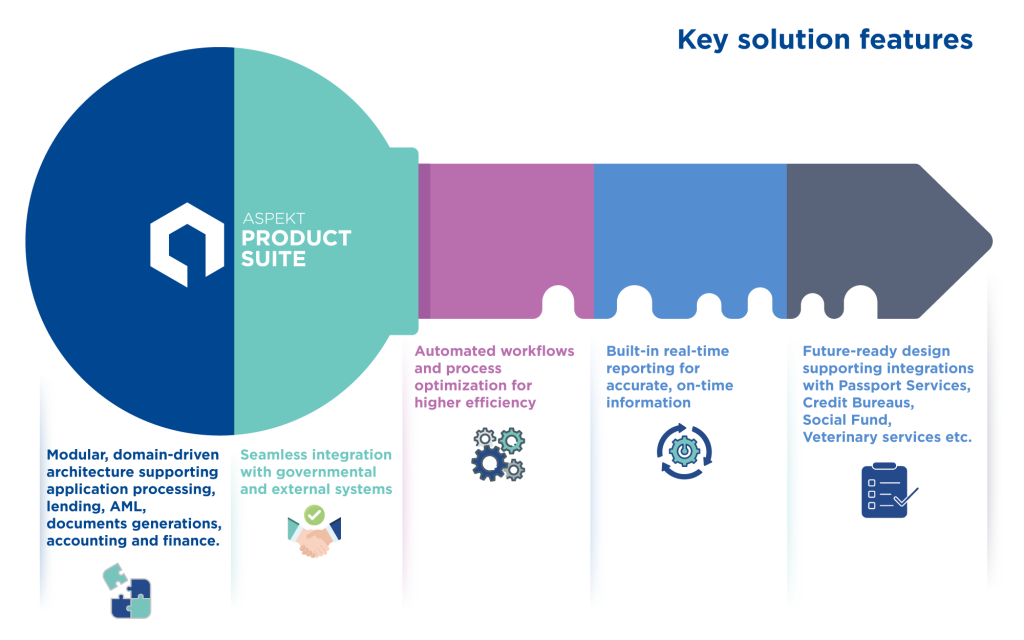

To support Oxus Kyrgyzstan’s expanding operations and evolving business needs, Aspekt implemented the Aspekt Product Suite, a comprehensive core banking platform that unified all major operational processes under a single core system.

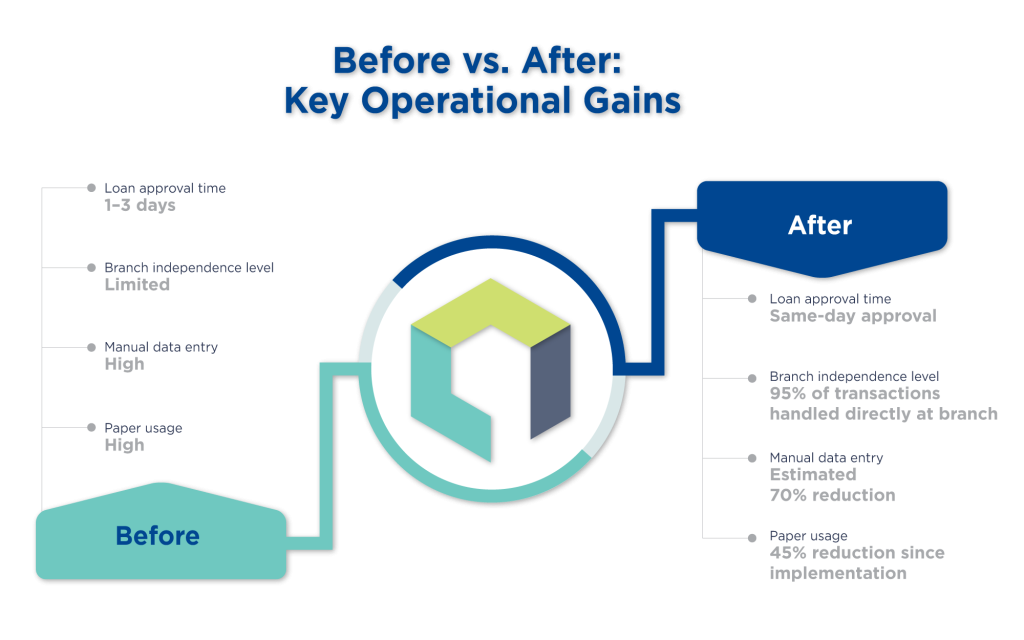

The implementation of centralized loan management, accounting, and reporting across all branches, improved consistency and control at every level. Automated workflows reduced manual errors and accelerated daily operations, while real-time reporting enhanced decision-making and compliance accuracy.

Integration with the Tunduk e-Interaction System and other third-party platforms strengthened internal controls and streamlined communication with external stakeholders. As part of the modernization roadmap, Oxus Kyrgyzstan extended the solution with two additional modules, CRM and Merchant, designed to elevate customer service, strengthen third-party connectivity, and enable new digital channels.

A collaborative implementation approach ensured success. Through a structured plan and comprehensive training, Aspekt’s team worked closely with Oxus Kyrgyzstan to achieve a smooth, phased transition, maintaining uninterrupted operations and laying a sustainable foundation for continued growth.

Transformative Technology: The Aspekt Product Suite

At the heart of this transformation lies the Aspekt Product Suite, a modular, domain-driven system designed to automate and integrate all core banking processes. By consolidating fragmented systems into one unified platform, Oxus Kyrgyzstan achieved faster operations, greater data accuracy, and improved decision-making.

Sustainability also improved, with reduced paper usage through digital documentation and system-based approvals. The platform’s adaptability allows Oxus Kyrgyzstan to seamlessly connect with new services, ensuring it remains agile and compliant as digital banking evolves.

The implementation of Aspekt’s core banking system marked a turning point in our digital transformation. Their team understood our operational realities and local requirements, and delivered a solution that has truly enhanced our efficiency, compliance, and service delivery. With this platform, we’re better equipped to grow fast and sustainably and continue supporting communities across Kyrgyzstan.

Denis Khoymyakov, CEO, OXUS Kyrgyzstan

The Results: A New Era in Financial Services

The transition to Aspekt Product Suite marked a major leap toward operational excellence. The system not only automated core processes but also strengthened compliance, improved client service, and supported sustainable growth.

Key Achievements

- Streamlined workflows – Faster transaction speeds and improved data accuracy

- Branch-level automation – Greater independence and faster customer service

- Enhanced system reliability – Strengthened security and simplified compliance

- Optimized operational agility – Institution-defined data entry and flexible reporting

- Sustainability – 40% reduction in paper usage with digital documentation

Looking Ahead: A Vision for the Future

Digital innovation is redefining the microfinance sector, and Oxus Kyrgyzstan is charting a transformation path focused on growth and inclusion. Beyond efficiency gains, digitalization strengthens financial inclusion by enabling access to underserved populations through digital channels. With a modern core banking system in place, Oxus Kyrgyzstan is now positioned to embrace future advancements, driving industry innovation and continue empowering communities across the region.

About OXUS

OXUS is an international microfinance network dedicated to supporting financial inclusion and economic empowerment in emerging markets. Founded in 2005, OXUS operates through subsidiaries in Kyrgyzstan, Tajikistan, and Afghanistan, serving more than 55,000 clients. With a focus on responsible lending and tailored financial services, OXUS works to improve the livelihoods of low-income individuals and small entrepreneurs, especially in underserved communities.